MSFT Stock: Is Microsoft Still the King of Tech?

When you think of tech giants, Microsoft (MSFT) probably tops the list. It’s the company that brought us Windows, Word, and Xbox. But in recent years, it’s been about more than just software. We’re talking AI, cloud computing, and some seriously strategic moves. So, the big question is: Is MSFT stock still a smart buy, or has the ship sailed? Let’s dive in and find out.

The Basics: What Is MSFT Stock?

MSFT is the stock ticker for Microsoft Corporation, one of the biggest companies on the planet. Founded in 1975 by Bill Gates and Paul Allen, Microsoft has evolved from a scrappy startup to a tech empire worth over $3 trillion as of 2025.

MSFT stock trades on the NASDAQ and is part of elite indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq-100. In other words, this isn’t some speculative penny stock—this is big-league investing.

Microsoft’s Core Businesses (And Why They Matter)

You might think Microsoft is all about Windows and Office, but that’s just scratching the surface. Let’s break down where they really make their money:

1. Cloud Computing (Azure)

This is the crown jewel. Azure is Microsoft’s answer to Amazon Web Services (AWS), and it’s growing fast. It powers everything from small business websites to massive AI models. Azure alone brings in billions in revenue each quarter.

2. Office 365 & Productivity Tools

From Word and Excel to Teams and Outlook, these tools dominate offices around the world. With everything now subscription-based, Microsoft gets a steady stream of recurring income. No more one-and-done software sales.

3. Windows & Devices

Windows is still everywhere—your laptop, your workplace, and even your grandma’s desktop. Add to that Surface tablets and accessories, and you’ve got a solid hardware footprint.

4. Gaming (Xbox & Activision Blizzard)

Yep, Microsoft owns Activision Blizzard now (hello, Call of Duty and Candy Crush). That’s a bold play in the gaming and metaverse spaces. Plus, Xbox and Game Pass continue to attract millions of gamers.

5. AI & Copilot

Thanks to their partnership with OpenAI, Microsoft is embedding AI into everything—Word, Excel, coding platforms, you name it. Their AI assistant, Copilot, could revolutionize how we work.

Why MSFT Stock Keeps Climbing

So why do investors keep piling into MSFT? Here’s why the stock continues to defy gravity:

🌩️ Strong Cloud Growth

Azure is gobbling up market share and giving Amazon a run for its money. That’s huge, considering cloud computing is expected to be a multi-trillion-dollar market in the coming years.

💰 Recurring Revenue Model

Thanks to subscriptions for Office 365, Xbox Game Pass, and even cloud services, Microsoft’s revenue is predictable and dependable. That’s music to Wall Street’s ears.

🚀 AI Advantage

Microsoft got in early with OpenAI, which powers ChatGPT (hey, that’s me!). That gives them a first-mover edge in the booming AI arms race.

🧠 Smart Acquisitions

LinkedIn, GitHub, and now Activision Blizzard? Microsoft has a knack for buying valuable assets and integrating them into its ecosystem.

Risks You Shouldn’t Ignore

Of course, no stock is without risk—even a juggernaut like Microsoft.

1. Regulatory Pressure

With great power comes great scrutiny. Microsoft’s size makes it a target for antitrust watchdogs, especially after buying up major companies.

2. Cloud Competition

Amazon (AWS), Google Cloud, and even smaller players aren’t backing down. Cloud wars are real, and market share can shift quickly.

3. Tech Market Volatility

Tech stocks can be a wild ride. One bad earnings report, and investors might start hitting the panic button.

4. Overvaluation Concerns

Let’s be real—MSFT isn’t cheap. Trading at a high P/E ratio, some argue it’s priced for perfection. Any slip-up could trigger a selloff.

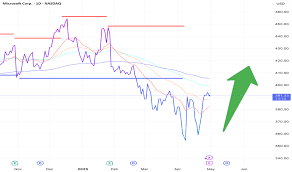

MSFT Stock Performance: Then vs. Now

Let’s talk numbers. Over the past 5 years, MSFT has:

-

More than doubled in value

-

Paid consistent dividends

-

Outperformed many tech peers

As of Q1 2025, MSFT is hovering around $420 per share, with a market cap of over $3 trillion. Not too shabby, right?

Even better? Microsoft is one of the few tech giants that’s not just growing fast—it’s also profitable. That’s a combo investors dream about.

Is MSFT a Buy Right Now?

If you’re wondering whether to pull the trigger on MSFT, here’s a quick rundown:

✅ You should consider it if:

-

You want blue-chip stability

-

You believe in the future of AI and cloud computing

-

You like companies with strong fundamentals and smart leadership (shoutout to CEO Satya Nadella)

❌ Maybe not if:

-

You’re looking for a cheap, high-risk, high-reward play

-

You’re nervous about tech sector pullbacks

-

You believe growth will slow in the next few years

Final Thoughts: Is MSFT Stock Still a Tech Titan?

In one word? Absolutely. Microsoft has proven that it’s not just surviving—it’s thriving in every major tech trend, from AI and cloud to gaming and enterprise tools. It’s like that straight-A student who also crushes sports, music, and the science fair. Annoying? Maybe. Impressive? Definitely.

Whether you’re building a long-term portfolio or just dipping your toes into tech stocks, MSFT remains one of the most reliable and forward-thinking companies out there.

So, is MSFT stock worth watching—or even buying? If you’re in it for the long haul, the answer is probably yes.